How Valley's AI Research Identifies Pain Points

Table of contents

Try Valley

Make LinkedIn your Greatest Revenue Channel ↓

Saniya Sood

Why Does Pain Point Identification Matter for Sales Conversations?

The most critical moment in any sales conversation happens when prospects recognize you understand their challenges. This recognition "you get my problem" builds trust and opens the door to solution discussions. Without accurate pain point identification, even perfect product-market fit fails to convert because conversations stay superficial.

Traditional pain point discovery relies on: asking prospects directly ("What challenges are you facing?"), making assumptions based on role stereotypes ("All VPs of Sales care about pipeline"), using generic industry research ("Companies in fintech struggle with compliance"), or hoping prospects volunteer their problems unprompted.

These approaches produce mixed results. Prospects don't always articulate pain points clearly, they may not recognize underlying issues, lack time to explain comprehensively, feel uncomfortable admitting challenges, or default to surface symptoms rather than root causes.

Valley's AI research addresses this by: analyzing role-specific challenges across hundreds of documented patterns, correlating company stage with typical pain points at that maturity level, identifying trigger events that create or amplify specific challenges, synthesizing multiple data sources to infer unstated pain points, and generating specific, relevant hypotheses for each prospect.

This research-driven approach enables reps to demonstrate understanding before prospects explain their situation, accelerating trust and credibility.

► Book a demo and explore how Valley can support your use case

How Does Valley Map Roles to Specific Pain Points?

Different roles face fundamentally different challenges. Valley's pain point identification begins with precise role-based mapping built from extensive analysis.

Role Pain Point Database:

Valley maintains documented pain points for hundreds of B2B roles across functional areas. Examples:

VP of Sales Pain Points:

Inconsistent pipeline generation across rep team

Inability to forecast accurately due to pipeline quality issues

Difficulty scaling team without degrading performance

Sales process inefficiencies extending cycle times

Lack of visibility into early-stage pipeline health

Territory planning and quota distribution challenges

Sales and marketing alignment gaps

CRM adoption and data quality problems

Head of Marketing Pain Points:

Attribution challenges connecting marketing spend to revenue

Content ROI measurement difficulties

Lead quality complaints from sales team

Marketing qualified lead (MQL) to sales qualified lead (SQL) conversion gaps

Channel optimization across multiple platforms

Brand awareness measurement in competitive markets

Budget justification without clear contribution metrics

Marketing technology stack complexity and integration issues

Director of Operations Pain Points:

Process documentation gaps creating inconsistency

Manual workflows consuming excessive time

System integration challenges between tools

Scalability concerns as company grows

Resource allocation inefficiencies

Data silos preventing holistic visibility

Change management resistance to new processes

Tool sprawl and duplicate functionality

Valley references these role-specific patterns during prospect research, identifying which pain points likely affect each prospect based on their position.

Seniority-Level Refinement:

Pain points vary by seniority even within same function:

C-Level (Strategic Focus):

Board-level reporting and accountability

Long-term strategic planning

Resource allocation across departments

Organizational structure and talent strategy

Market positioning and competitive response

Shareholder or investor management

VP-Level (Execution Focus):

Department performance and KPI achievement

Team building and talent development

Cross-functional collaboration

Budget management and ROI justification

Process optimization and efficiency

Technology stack decisions

Director-Level (Tactical Focus):

Day-to-day team management

Project execution and deliverables

Tool utilization and adoption

Performance coaching

Reporting and analytics

Workflow optimization

Manager-Level (Operational Focus):

Individual contributor productivity

Task prioritization and capacity planning

Quality control and consistency

Training and enablement

Immediate problem-solving

Tool proficiency

Valley adjusts pain point emphasis based on prospect seniority, ensuring relevant conversations.

How Does Valley Correlate Company Stage With Pain Points?

A VP of Sales at a 10-person seed-stage startup faces entirely different challenges than a VP of Sales at a 500-person Series C company. Valley analyzes company maturity to identify stage-specific pain points.

Seed Stage (0-20 employees, Pre-revenue to $1M ARR):

Primary pain points across roles:

Product-market fit validation uncertainty

Founder-led sales scaling challenges

First sales hire integration struggles

Minimal process documentation

Resource constraints forcing tool choices

Inability to afford specialized roles

Rapid priority shifts and pivots

For VP Sales at seed company, Valley emphasizes:

"You're probably still defining repeatable sales process"

"Balancing founder involvement with building scalable team"

"Choosing tools that work now and scale later"

Series A (20-50 employees, $1M-$5M ARR):

Primary pain points:

Scaling beyond founder sales motion

Building repeatable processes that work

Hiring fast enough to meet growth targets

Balancing rapid experimentation with consistency

Tool proliferation creating integration nightmares

Metrics definition and tracking challenges

For VP Sales at Series A, Valley emphasizes:

"Transitioning from scrappy to systematic"

"Building SDR function that actually works"

"Proving ROI on new tools and headcount"

Series B (50-150 employees, $5M-$20M ARR):

Primary pain points:

Process standardization across growing team

Maintaining culture during rapid hiring

Specialization creating new coordination challenges

Predictable pipeline generation at scale

Sales and marketing alignment breakdowns

Technology stack complexity management

For VP Sales at Series B, Valley emphasizes:

"Maintaining velocity while adding structure"

"Coordinating specialized teams (SDRs, AEs, SEs)"

"Predictable forecasting with larger numbers"

Series C+ (150+ employees, $20M+ ARR):

Primary pain points:

Enterprise sales motion complexity

Geographic expansion coordination

Product line proliferation challenges

Sales efficiency optimization (not just growth)

Competitive pressures in maturing market

Board and investor reporting expectations

Talent retention and development at scale

For VP Sales at Series C+, Valley emphasizes:

"Optimizing efficiency ratios and cost of sale"

"Managing complex product portfolio"

"Competitive differentiation as market matures"

Valley identifies company stage through: employee count from LinkedIn company page, funding data from Crunchbase and public announcements, revenue estimates from business databases, job posting volume and growth trajectory, and public statements about company milestones.

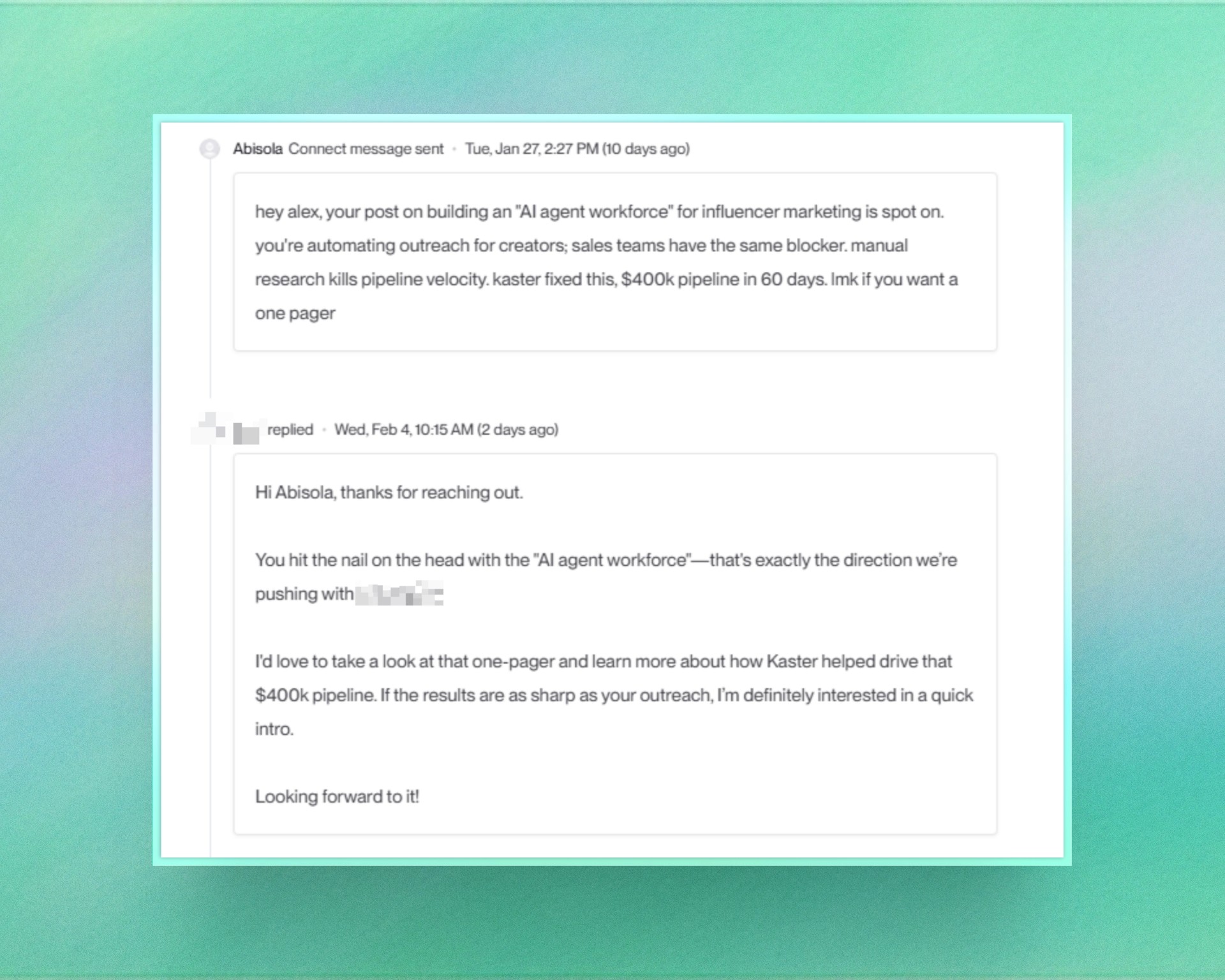

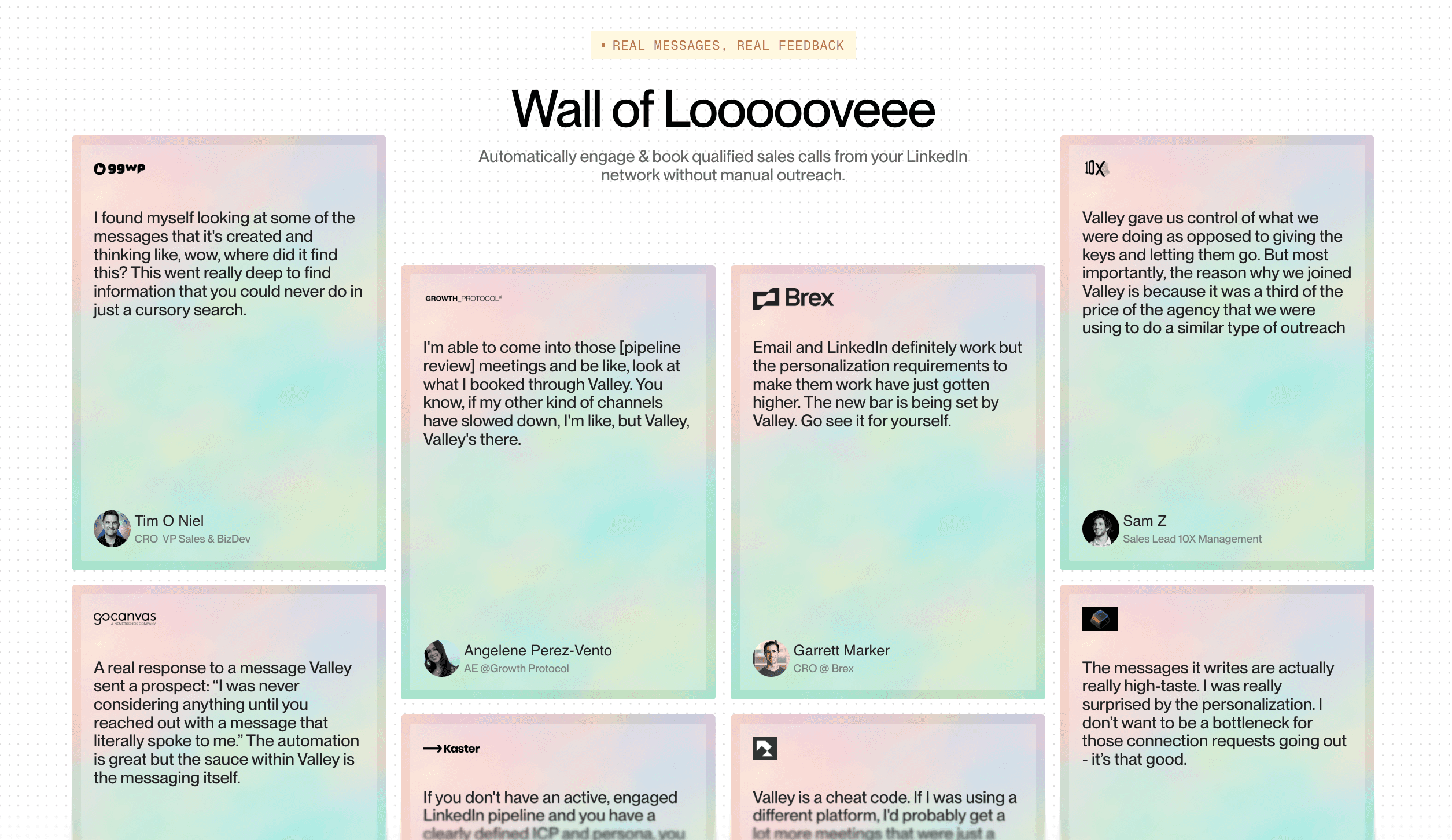

► Check Out More of Valley's Incredible Outreach: A compilation of real time messages and responses!

How Does Valley Identify Trigger Events That Create or Amplify Pain Points?

Timing matters enormously in sales. The same prospect who ignored outreach three months ago might be actively seeking solutions today because circumstances changed. Valley identifies these trigger events.

Funding Announcements (Growth Urgency):

When companies raise funding, specific pain points intensify:

Hiring pressure (need to deploy capital, build team fast)

Scaling challenges (previous processes don't work at new scale)

Board expectations (demonstrate progress toward milestones)

Tool evaluation (budget available for infrastructure)

Market expansion (new geographies or segments require new approaches)

Valley detects funding from: news mentions, Crunchbase updates, LinkedIn company page announcements, and PR releases.

When messaging VP Sales at recently funded company: "I saw [Company] recently raised [$X]. That typically creates pressure to scale the team and hit aggressive growth targets. How are you approaching building out your sales infrastructure to support that?"

Executive Hires (Priority Shifts):

New leaders bring new initiatives and pain points:

New CRO hire: likely reevaluating entire GTM stack and process

New CMO hire: probably changing marketing strategy and tooling

New VP Sales: often brings new methodologies and vendor preferences

New Head of Ops: typically standardizes processes and consolidates tools

Valley monitors LinkedIn for executive job changes at target companies.

When messaging new CRO: "I noticed you recently joined [Company] as CRO. Typically that first 90 days involves evaluating GTM infrastructure. How are you approaching that assessment?"

Expansion Announcements (Operational Challenges):

Company growth creates operational pain:

New office opening: coordination and consistency challenges

International expansion: localization and remote management

Product line addition: go-to-market complexity increases

Market segment entry: new buyer personas and messaging needed

Valley finds expansion news through: company blog posts, LinkedIn updates, job postings in new locations, and news articles.

Competitive Events (Market Pressure):

When competitors make moves, prospects feel pressure:

Competitor funding announcement (fear of being outspent)

Competitor product launch (need to match capabilities)

Competitor customer win (lost deal motivates change)

Industry consolidation (need to remain competitive)

Valley tracks competitor activity relevant to your market.

Regulatory Changes (Compliance Pressure):

New regulations create urgent pain points in affected industries:

GDPR in Europe affecting data handling

CCPA in California creating compliance requirements

Industry-specific regulations (healthcare, financial services)

Security standards becoming mandatory

Valley correlates prospect industry with relevant regulatory developments.

How Does Valley Synthesize Multiple Data Sources to Infer Unstated Pain Points?

The most sophisticated pain point identification comes from connecting disparate data points that individually seem insignificant but collectively reveal challenges.

Technology Stack Analysis:

Valley examines tools prospects use to infer pain points:

Using basic/outdated tools in critical areas: If VP Sales uses generic spreadsheets instead of modern sales engagement platform: Inferred pain point: "Likely struggling with sales team efficiency and lack of automation"

Using too many tools (over 15 in martech stack): Inferred pain point: "Probably experiencing integration challenges, data silos, and excessive cost"

Missing critical tool categories: No sales intelligence platform: "Likely relying on manual prospect research, wasting rep time" No revenue analytics tool: "Probably struggling with forecasting accuracy and pipeline visibility"

Hiring Pattern Analysis:

Job postings reveal organizational priorities and gaps:

Hiring multiple SDRs simultaneously: Inferred pain point: "Pipeline generation struggling to keep pace with growth targets"

Hiring Operations roles (Sales Ops, Revenue Ops): Inferred pain point: "Processes breaking down, need systematization"

Hiring enablement roles: Inferred pain point: "Onboarding and training challenges with growing team"

Content Analysis:

LinkedIn posts and content engagement reveal concerns:

Executive posting about specific challenges: CEO writes about: "The hardest part of scaling is maintaining culture" → Company experiencing growth pain

Engaging with content about specific topics: VP Sales engaging with posts about pipeline generation, forecasting, CRM adoption → These are active pain points

Company blog topics: Blog posts about: "How we're rebuilding our sales process" → Process challenges currently being addressed

Review Site Feedback:

G2, Capterra, and similar sites show pain points through tools they review:

Reviewing competitor tools: Actively evaluating solutions in your category → Pain point exists, timing is now

Negative reviews of current tools: Complaining about features or support → Dissatisfaction, potential switching opportunity

Seeking specific capabilities: Looking for "better reporting" or "easier integrations" → Specific pain points articulated

Valley's Synthesis:

Valley's AI combines these inputs: Role (VP Sales) + Stage (Series B) + Trigger (Recent funding) + Tech Stack (Missing sales intelligence) + Hiring (3 SDR openings) + Content (Engaging with pipeline generation content).

Synthesized pain point hypothesis: "You're likely facing pressure to scale pipeline generation quickly after your recent funding round. With several SDR openings and current manual research processes, you're probably concerned about maintaining quality while hitting volume targets. The lack of sales intelligence automation is creating bottlenecks."

This specific, researched hypothesis demonstrates understanding before prospect explains their situation.

How Accurate Is Valley's AI Pain Point Identification?

No AI achieves 100% accuracy predicting prospect challenges. Valley's approach aims for useful accuracy that improves conversation quality even when not perfect.

Accuracy Measurement:

Valley tracks pain point accuracy through: prospect confirmation rate (how often prospects agree with hypothesized pain points), conversation relevance scores (reps rate if research was useful), meeting conversion rates (better pain point accuracy → more meetings), and sales cycle velocity (accurate pain points accelerate deals).

Current Performance Benchmarks:

Based on Valley usage data: 70-80% of role-based pain points resonate with prospects (recognized as actual challenges), 60-70% of company stage pain points prove relevant, 80-90% of trigger event pain points are timely and accurate, 50-60% of inferred pain points (from synthesis) prove correct.

When Valley Gets It Wrong:

Common inaccuracy scenarios:

Outlier companies: Company doesn't follow typical patterns for their stage/role. Example: Series B company with exceptional process maturity beyond their stage.

Recent role changes: Prospect just started role, previous role pain points don't apply yet.

Unique situations: Merger, acquisition, major pivot, crisis → creates non-standard pain points.

Industry-specific nuances: Some verticals have unique challenges not captured in general role patterns.

Graceful Failure:

Even when pain point hypotheses are wrong, they provide conversation value: Opens dialogue about actual pain points ("That's not our biggest challenge, but we do struggle with X"), Demonstrates research effort and preparation, Shows understanding of role even if specifics miss, Provides opportunity to learn and refine.

Better to hypothesize incorrectly than ask generic: "So, what keeps you up at night?"

How to Use Valley's Pain Point Research in Conversations?

Research only creates value when sales reps apply it effectively in actual conversations with prospects.

Opening with Pain Point Hypothesis:

Instead of: "Tell me about your challenges"

Try: "Based on your role and [Company's] recent [trigger event], I imagine you're probably dealing with [specific pain point hypothesis]. Is that resonating or am I off base?"

This frames you as expert understanding their world rather than consultant gathering information from scratch.

Pain Point Layering:

Start broad, then go specific based on response:

Layer 1 (Broad): "Most [role titles] at [company stage] companies struggle with [general pain point category]. Is that true for you?"

Layer 2 (Specific): If they confirm: "Where specifically does that show up? Is it more [specific manifestation A] or [specific manifestation B]?"

Layer 3 (Quantification): "How much is that costing you in [time/money/opportunity]?"

Layer 4 (Solution Urgency): "What happens if you don't solve this in the next [timeframe]?"

This layering reaches real pain depth quickly.

Pain Point Validation:

Test Valley's hypotheses explicitly: "I did some research before reaching out and noticed [data point suggesting pain point]. Am I reading that correctly?"

This shows preparation while remaining humble about accuracy.

Connecting Pain to Value:

Once pain point confirmed, connect to your solution: "We help [companies like theirs] address [confirmed pain point] by [your approach]. Specifically, we've seen [measurable outcome]."

Pain Point Documentation:

Log confirmed pain points back into Valley: Which research pain points proved accurate, Which inferred points were wrong, What unexpected pain points emerged, How prospects describe challenges in their words.

This feedback improves Valley's future research for similar prospects.

Valley's AI pain point identification transforms prospect conversations from discovery interrogations into informed dialogues where sales reps demonstrate expertise, build credibility faster, and reach valuable conversations sooner.

VALLEY MAGIC