How Valley Turns Website Visitors Into LinkedIn Conversations

Table of contents

Try Valley

Make LinkedIn your Greatest Revenue Channel ↓

Saniya Sood

Why Do 95% of Your Website Visitors Leave Without Converting?

Your website receives hundreds or thousands of visitors monthly. Marketing teams celebrate traffic growth. But here's the uncomfortable truth: 95-98% of visitors never fill out a form, never book a demo, never identify themselves.

They research, evaluate, compare and then vanish without trace.

Traditional response: accept this reality, optimize for the 2-5% who convert, hope email retargeting catches some browsers, run expensive retargeting ads to anonymous visitors, and pray they return and convert eventually.

This acceptance costs companies millions in lost pipeline. Those anonymous visitors aren't random traffic, many represent your exact ICP actively researching solutions.

They're reading your pricing page, studying case studies, comparing you to competitors.

These are warm, qualified prospects demonstrating buying intent through behavior.

Valley transforms this dynamic by: identifying which companies visit your website (even anonymous visitors), finding the right decision-makers at those visiting companies, researching why they're interested based on pages viewed, initiating personalized LinkedIn outreach while interest is fresh, and converting anonymous website traffic into real conversations.

The value proposition: your marketing team drives traffic (their job), Valley converts that traffic into identified prospects and booked meetings (sales' job), eliminating the massive gap between website visits and actual pipeline.

► Book a demo and explore how Valley can support your use case

How Does Valley Identify Anonymous Website Visitors?

When someone visits your website without filling a form, they remain anonymous to traditional analytics. Valley uses IP-based company identification to reveal which organizations are researching you.

IP-to-Company Matching Technology:

Every website visitor arrives with an IP address. Valley's system: captures the visitor's IP address through tracking pixel, matches IP to company database (business ISPs and corporate networks), identifies the company name and firmographic data, enriches with company details (size, industry, location, etc.), provides this intelligence in your Valley dashboard.

Important limitation: Valley identifies the company visiting, not the specific individual initially. IP tracking reveals "Someone from Salesforce visited your pricing page" but not "John Smith, VP Sales at Salesforce."

This company-level identification still provides immense value because Valley's next step finds the right people at identified companies.

What Valley Tracks:

Beyond just company identification, Valley captures: which pages they viewed (pricing, case studies, product features, blog posts), time spent on each page, total session duration, return visits (came back multiple times?), traffic source (how they found you: LinkedIn post, Google search, direct), and technology signals (if detectable from headers).

Example Visitor Journey:

Day 1:

Anonymous visitor from Acme Corp (500 employees, B2B SaaS) arrives via LinkedIn post, views: homepage (2 min), product page (4 min), pricing page (3 min), case study page (5 min). Total session: 14 minutes.

Day 3:

Same company returns, views: blog post about LinkedIn outbound (6 min), pricing page again (2 min), booking page but doesn't convert (1 min).

Valley intelligence:

"Acme Corp showed high intent, 14 minute first session, pricing page views on both visits, returned within 3 days. Strong buying signal."

Privacy and Compliance:

Valley's IP identification operates within privacy frameworks: no personal data collected until LinkedIn connection, complies with GDPR and privacy regulations, doesn't use cookies requiring consent, identifies business entities, not individuals, and prospects can opt out at any time.

The technology reveals companies researching you, legitimate business intelligence: without tracking individuals' personal browsing.

How Does Valley Find the Right Decision-Makers at Visiting Companies?

Knowing "someone from Acme Corp visited" isn't enough. Valley needs to identify which specific people at Acme Corp should receive outreach.

LinkedIn-Based Stakeholder Discovery:

Once Valley identifies a visiting company, it searches LinkedIn for relevant decision-makers:

Step 1: ICP-Based Role Filtering

Valley searches LinkedIn for employees at identified company matching your ICP: target job titles (VP Sales, Director of Marketing, Head of Revenue Operations, etc.), seniority levels (Director+, VP+, C-level), departments (Sales, Marketing, Operations, etc.), and location requirements if specified.

Example: Acme Corp visit identified → Valley finds: Sarah Johnson - VP Sales, Michael Chen - Director of Sales Operations, Jennifer Martinez - Head of Demand Generation.

Step 2: Signal Enrichment

Valley doesn't just find names: it checks for additional signals: have any of these people viewed your LinkedIn profile recently?, did they engage with your LinkedIn posts?, are they following your company page?, and did they previously visit website from different sessions?

Multi-signal prospects get priority: If Sarah Johnson (VP Sales) at visiting company also viewed your profile twice this week, that's maximum intent.

Step 3: Buyer Committee Identification

For strategic accounts, Valley can identify complete buying committees: economic buyer (budget authority, typically C-level or VP), technical buyer (evaluates product fit, typically VP Engineering, CTO), user buyer (will use the product, Directors, Managers), influencers (provide input, various roles), and champions (internal advocates anyone highly engaged).

This comprehensive mapping enables coordinated account-based outreach.

Visitor Attribution:

Valley attempts to correlate website visits with specific individuals when possible: if visitor clicked from LinkedIn post, LinkedIn may provide referrer data, if visitor viewed your profile then visited website, timing correlation suggests same person, and return visits from same company tracked as sustained organizational interest.

What Page-Level Intelligence Does Valley Provide for Personalization?

Not all website visits signal equal intent. Someone reading a blog post shows different interest than someone studying your pricing page. Valley's page-level tracking enables precise personalization.

High-Intent Pages (Immediate Outreach Warranted):

Pricing Page Visitors: Intent level: Very high: actively evaluating cost Urgency: Same-day outreach Message angle: "I saw someone from [Company] was checking out our pricing yesterday. Happy to answer any questions or walk through how we typically work with [company type] teams."

Conversion rate: 15-25% booking rate from pricing page visitors

Demo/Trial Request Pages (Viewed But Not Submitted): Intent level: Extremely high—on verge of conversion Urgency: Immediate (within hours) Message angle: "Noticed you were on our demo request page. If you have questions before booking, I'm happy to jump on a quick call. Or here's my calendar if you'd like to schedule directly."

Conversion rate: 25-35% booking rate

Case Study Pages (Especially Relevant Industries): Intent level: High—researching proof points Urgency: Same-day to next-day Message angle: "Saw you were reading our case study about [similar company]. They faced [challenge]—is that resonating with your situation at [Company]?"

Conversion rate: 12-18% booking rate

Comparison Pages (Valley vs. Competitor): Intent level: Very high—active vendor evaluation Urgency: Same-day Message angle: "I noticed you were comparing our approach to [Competitor]. Happy to walk through the key differences and help you evaluate fit. What's driving your evaluation?"

Conversion rate: 18-25% booking rate

Medium-Intent Pages (Nurture Sequences Appropriate):

Product/Features Pages: Intent level: Moderate—learning about capabilities Approach: LinkedIn connection + value-first message Message angle: "Saw you were exploring our [specific feature]. We recently published a framework on [related topic] that might be useful. Want me to send it over?"

Blog Posts: Intent level: Low-moderate—educational research Approach: Engage with relevant content, soft outreach Message angle: "Noticed you read our post about [topic]. We've been writing a lot about that—what questions are you trying to answer in this area?"

About/Team Pages: Intent level: Low—general company research Approach: Light touch, relationship building Message angle: "Thanks for checking out [Company]. Curious what brought you to our site?"

Low-Intent Pages (Minimal or No Outreach):

Careers Page: Intent: Job seeking, not buying Action: Exclude from sales outreach (potential recruit, not prospect)

Press/News Pages: Intent: General awareness, journalism research Action: Light outreach only if other signals present

Contact/Office Location Pages: Intent: Ambiguous Action: Wait for additional signals before outreach

Page Sequence Analysis:

Valley tracks page view order to infer intent:

Pricing → Case Study → Demo Page = Hot buyer journey,

Blog → Product → Pricing = Educational research becoming serious evaluation,

Homepage only = Minimal intent.

Time-on-Page Signals:

Duration spent reveals engagement quality: 10+ seconds on pricing page (actually reading), 5+ minutes on case study (deep research), multiple page views in session (comprehensive evaluation), return visits to same pages (serious consideration).

Quick bounces (< 10 seconds) suggest accidental clicks or irrelevance, lower priority.

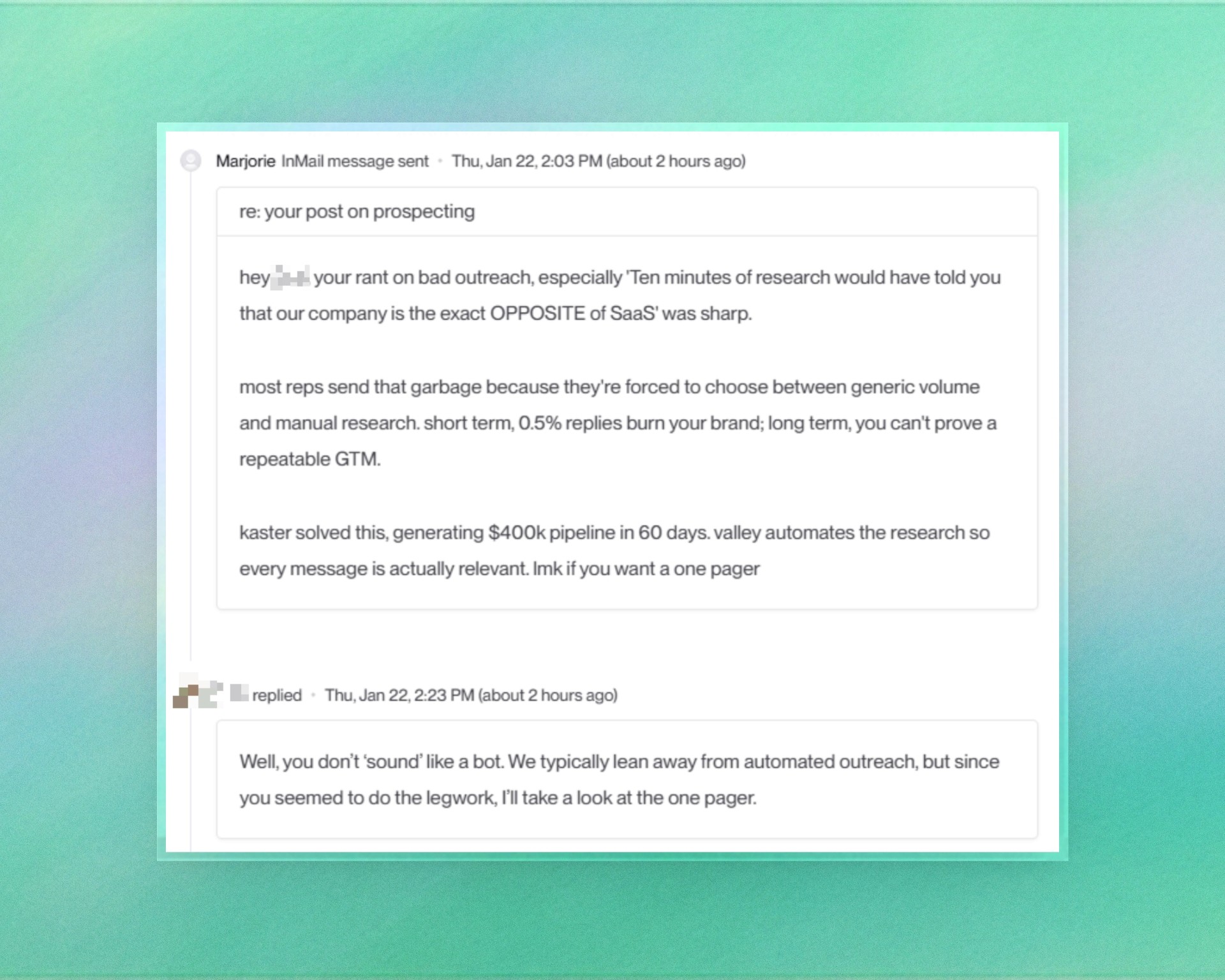

► Check Out More of Valley's Incredible Outreach: A compilation of real time messages and responses!

How Quickly Should You Contact Website Visitors Through Valley?

Timing dramatically impacts conversion rates. Speed-to-contact matters more for website visitors than almost any other signal type because their intent is time-sensitive.

The Speed-to-Contact Data:

Studies across B2B sales consistently show: contacted within 1 hour: 7x higher conversion than waiting 24 hours, contacted within 24 hours: 60% higher conversion than waiting week, contacted within 1 week: conversion drops to baseline cold outreach levels.

Website visitors are actively researching now. Waiting allows: interest to cool ("I looked at several tools, moved on"), competitors to engage them first, context to be forgotten ("Why is Valley reaching out?"), and urgency to dissipate.

Valley's Speed Advantage:

Valley enables same-day or next-day outreach: real-time visitor identification (within hours of visit), automatic decision-maker discovery at visiting company, instant AI-generated personalized messages, immediate outreach or queue for next-day sending.

Recommended Timing by Page Type:

Pricing/Demo Pages: Target: Same-day outreach (within 6 hours if possible) Rationale: Highest intent, shortest attention span, likely comparing vendors simultaneously

Case Studies/Product Pages: Target: Next-day outreach (within 24 hours) Rationale: Still high intent but slightly longer evaluation window

Blog/Educational Content: Target: 2-3 day window acceptable Rationale: Educational research timeline extends longer

Operational Timing:

Most teams configure Valley for: Morning check (8-9 AM): Review yesterday's high-intent visitors (pricing, demo pages), immediate outreach to hottest prospects, Afternoon check (2-3 PM): Review morning visitors, queue for next-day outreach, Weekly batch: Lower-intent visitors added to nurture campaigns.

After-Hours Visitors:

Visitors arriving evenings/weekends still warrant fast response: Valley captures them overnight, morning review catches these visitors, outreach same business day.

Example: Prospect visits pricing page Saturday afternoon → Valley identifies them → Monday morning, rep reaches out: "I saw you were checking out our pricing over the weekend. Seemed like you were doing some research, happy to answer questions."

Weekend research often indicates personal initiative and serious interest.

How Does Valley's Website Visitor Tracking Compare to Traditional Tools?

Most companies already use website analytics and visitor identification tools. How does Valley's approach differ and add value?

Valley vs. Google Analytics:

Google Analytics shows: pageviews, sessions, traffic sources, behavior flow, conversion rates.

But doesn't provide: company identification from anonymous visitors, decision-maker names and contacts, outreach automation, LinkedIn integration.

Valley complements Analytics: Analytics shows "500 visitors this month", Valley identifies "250 came from qualified target companies", Valley finds decision-makers at those 250 companies, Valley initiates conversations with them.

Valley vs. Clearbit/6sense/Demandbase:

These tools offer similar IP-to-company identification. Key differences:

Coverage overlap: Valley and these tools identify similar companies (all use IP databases)

Valley's LinkedIn advantage: After identification, Valley finds decision-makers on LinkedIn and messages them directly. Other tools require separate outreach workflow.

Integration complexity: Traditional tools require: website pixel installation, CRM integration, sales engagement platform connection, manual workflow creation.

Valley integrates identification + outreach in one platform—simpler stack.

Cost comparison:

Clearbit/6sense: $1,000-$3,000/month minimum,

Valley: $347-$849/month including visitor ID + outreach.

Valley vs. Leadfeeder/Albacross:

These visitor identification tools provide company lists. Similarities: Both identify companies from IP addresses, both show pages viewed.

Differences: They stop at identification—you manually research and reach out, Valley automatically finds decision-makers and personalizes outreach, they require separate prospecting tools, Valley combines identification + engagement.

The Stack Consolidation Value:

Traditional approach requires: Website analytics ($0-500/month), Visitor identification ($500-1,500/month), LinkedIn Sales Navigator ($99/month), LinkedIn automation tool ($79-199/month), Sales engagement platform ($100-150/month).

Total: $778-2,448/month for fragmented workflow.

Valley approach: Website visitor identification + decision-maker discovery + LinkedIn outreach automation: $347-849/month for integrated workflow.

Integration Architecture:

Valley's website tracking requires minimal setup: add tracking pixel to website (one-time, 10-minute task), connect LinkedIn account, configure ICP for decision-maker filtering, set up outreach campaigns.

No complex CRM integrations, no sales platform connections, no multi-tool workflows—just pixel + LinkedIn + Valley.

What Results Can Teams Expect From Valley's Website Visitor Campaigns?

Website visitor conversion represents some of Valley's highest-performing campaigns due to demonstrated intent and fresh timing.

Volume Expectations:

Volume depends on your website traffic: 1,000 monthly visitors → ~300-400 identifiable companies → ~150-200 ICP-fit companies → ~100-150 decision-makers found.

5,000 monthly visitors → ~1,500-2,000 identifiable companies → ~750-1,000 ICP-fit companies → ~500-750 decision-makers found.

Not all website traffic converts to Valley prospects: Consumer traffic (if B2C component exists), small businesses below your ICP, international traffic outside target markets, and bot/scraper traffic gets filtered out.

Engagement Metrics:

Response rates from website visitor outreach: All website visitors: 10-15% response rate, Pricing page visitors: 18-25% response rate, Return visitors (2+ sessions): 20-30% response rate, Multi-signal visitors (also viewed profile, engaged with content): 30-40% response rate.

These rates significantly exceed cold outreach (1-2%) because prospects already demonstrated interest.

Meeting Conversion:

From responses, meeting booking rates: Pricing page visitor conversations: 40-50% book meetings (very high intent), Product page visitors: 30-40% book meetings, Blog readers: 15-25% book meetings (lower intent, educational).

Pipeline Impact:

Realistic monthly pipeline from website visitor campaigns: 1,000 visitors/month → 100 decision-makers identified → 12-15 responses → 5-7 meetings → $25K-$40K pipeline (at $20K average deal size).

5,000 visitors/month → 500 decision-makers identified → 60-75 responses → 25-35 meetings → $125K-$175K pipeline.

Time to Meeting:

Website visitor campaigns convert faster than other sources: Average 5-7 days from website visit to booked meeting (vs. 14-21 days for cold outreach).

Speed results from: fresh intent (they just researched you), immediate outreach (same/next day contact), high relevance (contextual conversation).

Attribution Clarity:

Valley's visitor tracking provides clear attribution: Visitor from Acme Corp identified 2/15 → Outreach sent 2/16 → Response received 2/17 → Meeting booked 2/18 → Opportunity created 2/25.

Clean attribution from website marketing to closed pipeline.

ROI Calculation Example:

Website marketing spend: $5,000/month (content, SEO, ads driving traffic), Valley cost: $849/month (3-seat deployment), Combined marketing + Valley: $5,849/month.

Results: 5,000 monthly visitors → 25-35 meetings → $125K-$175K pipeline → $37.5K-$52.5K revenue at 30% win rate.

ROI: 6.4-9x return on combined marketing + Valley investment.

Valley multiplies marketing ROI by converting traffic marketing drives into actual pipeline.

Success Pattern:

Companies succeeding with Valley visitor campaigns: drive consistent website traffic (through content, SEO, ads, social), target ICP matches Valley's decision-maker discovery, respond quickly when Valley identifies visitors (speed matters), personalize outreach based on pages viewed.

Valley doesn't replace website optimization or conversion rate optimization: it captures the 95% who don't convert organically, turning anonymous researchers into identified prospects and booked meetings.

► Here's the Valley Warm Outbound Launch Video which I spent way too much money on.

VALLEY MAGIC