What Are Valley's Real Performance Metrics and Success Rates?

Table of contents

Try Valley

Make LinkedIn your Greatest Revenue Channel ↓

Saniya Sood

What Response Rates Does Valley Actually Achieve in Production?

Valley customers consistently report response rates that dramatically exceed industry standards, with real production data showing 9-11% average reply rates across all campaigns. This represents a 5-10x improvement over traditional cold outreach methods, where 1-2% response rates are considered acceptable.

The breakdown by campaign type reveals even more impressive numbers. For InMail campaigns, customers report rates ranging from 6% minimum to 24% for top performers, with most falling in the 10-12% range. Connection request campaigns show 35-40% acceptance rates (versus 20-25% industry average), with 20% of accepted connections replying, resulting in overall response rates around 15-20%. Some users report exceptional results: "I got a 71% response rate with 600 prospects" and "Our campaigns show 65% acceptance rate and ~50% reply rate."

These aren't cherry-picked examples. Valley's own team, running 20 LinkedIn accounts, consistently books 200-250 meetings per month. That's 10-12 meetings per account per month, far exceeding what most SDRs achieve manually. The key difference? Valley's deep personalization and research make every message feel individually crafted, dramatically increasing engagement rates.

► Book a demo and explore how Valley can support your use case.

How Many Meetings Does Valley Book Per LinkedIn Account Per Month?

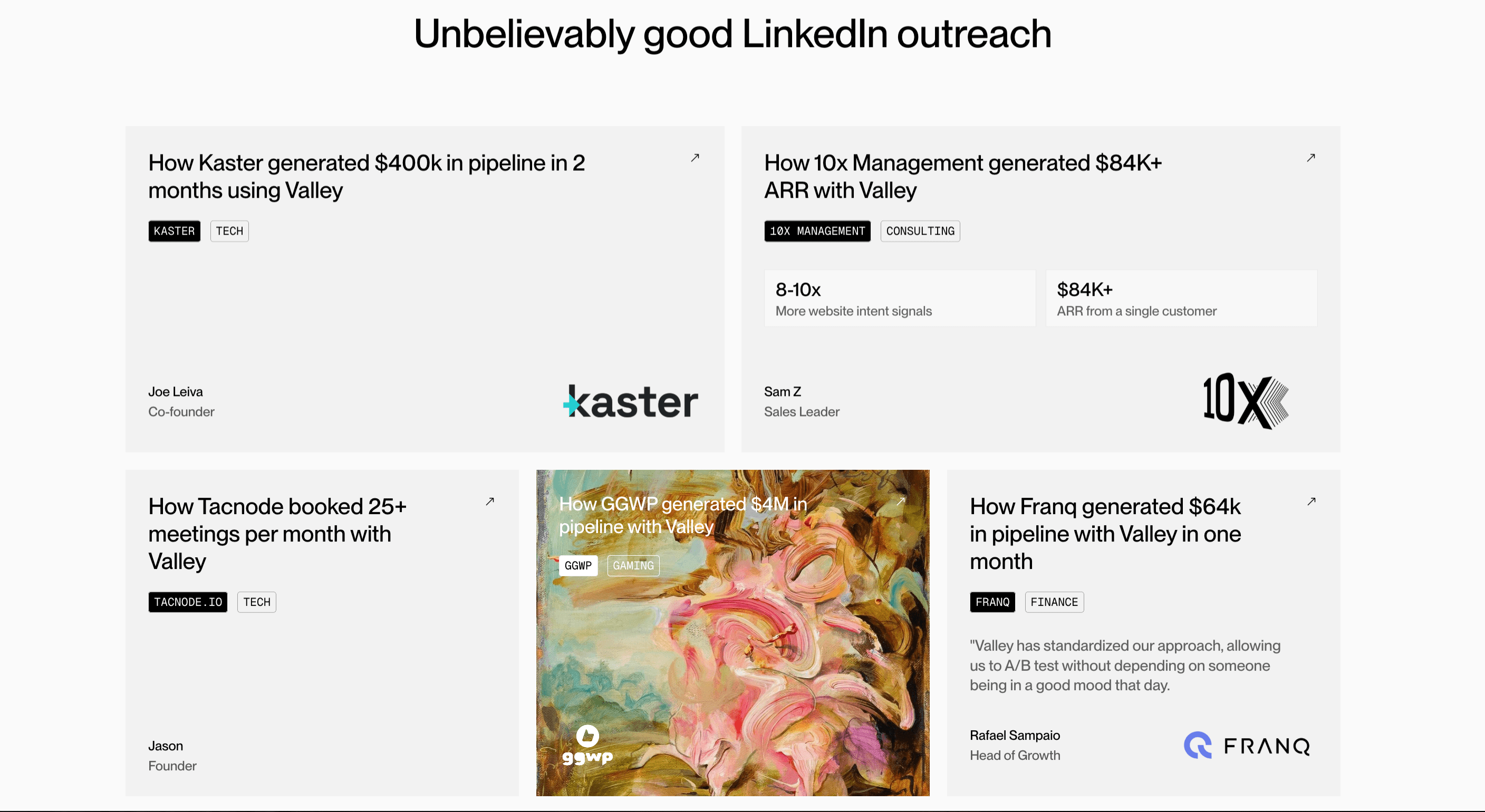

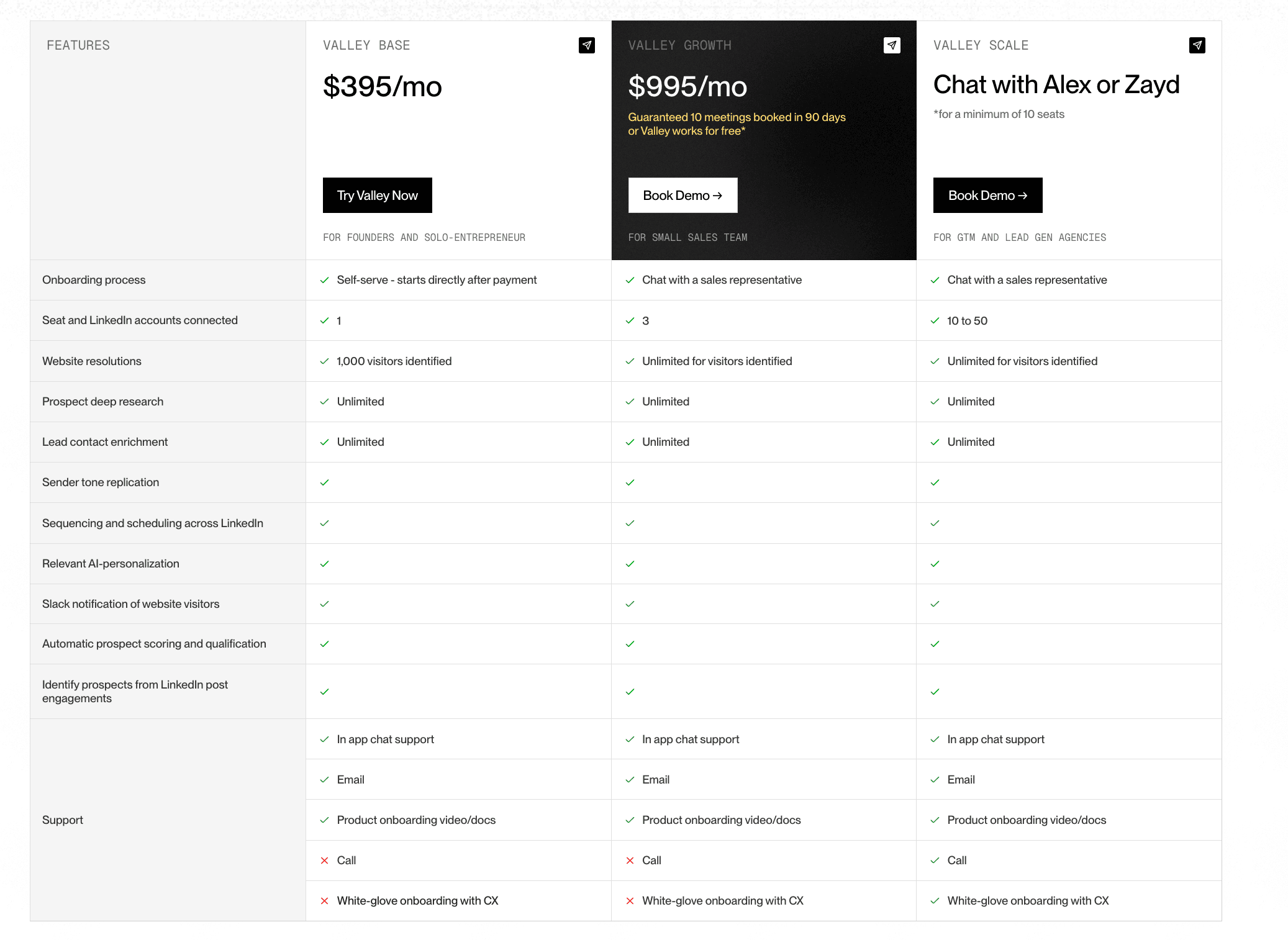

Valley's meeting generation varies based on several factors, but the data shows consistent patterns. Average performance is 8-15 meetings per account monthly, with top performers reaching 20-25 meetings. Valley provides a conservative guarantee of 10 meetings in 90 days for three accounts (roughly 3.3 meetings per account over three months), but most customers far exceed this minimum.

Real customer examples illustrate the range: "Last month alone it was like at least 20 to 25 meetings" reported one user. Another shared: "I booked two meetings last Friday for today." An agency owner noted: "I'll be booking 11-12 meetings for this client and they're very happy with the results." These aren't outliers - they represent typical Valley performance when properly configured.

The meeting quality is equally important. Because Valley qualifies prospects before outreach and personalizes based on deep research, these aren't just calendar fills - they're qualified opportunities with genuine interest. Users report that Valley meetings convert to opportunities at higher rates than traditional SDR-booked meetings because the personalization creates stronger initial engagement.

► Check Valley's Outreach: A compilation of real time messages and responses!

What's the Timeline from Valley Setup to First Booked Meeting?

Valley follows a predictable success timeline that allows for accurate pipeline forecasting. Week 1-2 brings first positive replies, as prospects begin engaging with personalized messages. By the end of Month 1, users typically book their first meetings. Months 2-3 see significant volume increases as the AI optimizes based on feedback and users refine their approach.

The setup phase is remarkably quick: 30 minutes to configure products and writing style, 2-3 days before first messages go out (including initial AI training), and positive responses within the first week of outreach. One user reported: "We got four meetings in the first week and at least six more since then," demonstrating that fast results are possible with proper setup.

This rapid time-to-value is crucial for ROI calculations. Unlike traditional SDR hiring (with 3-6 month ramp times) or agency engagements (with long onboarding periods), Valley delivers measurable results within weeks. The platform's learning curve accelerates results over time - what starts as a trickle of meetings in week one becomes a steady flow by month three.

How Does Valley's Performance Compare to Email Outreach?

The data consistently shows Valley's LinkedIn approach outperforms email by 5-10x. While email campaigns average 1-2% response rates (and declining), Valley achieves 9-11% response rates consistently. One customer provided direct comparison: "Email: 2% response rate average. LinkedIn via Valley: 10%+ response rate average. That's 5x better than email."

The performance gap extends beyond just response rates. Valley messages land directly in LinkedIn inboxes without spam filters, achieve near-100% deliverability (versus email's 70-80% inbox placement), and benefit from profile context that builds immediate credibility. As one user noted: "I get no responses from emails and I've got thousands out there," while their Valley campaigns generate consistent meetings.

The quality difference is equally striking. LinkedIn responses tend to be more substantive and qualified because prospects can immediately verify the sender's credibility through their profile. This transparency creates trust that email can't match, leading to higher meeting attendance rates and better conversion to opportunities.

What Factors Most Impact Valley's Campaign Performance?

Valley's performance data reveals clear patterns in what drives success. Sender authority shows measurable impact: CEO/Founder profiles achieve +5% response rates, C-suite executives see +3-4% boost, while individual contributors achieve baseline (still strong) results. This authority effect compounds with Valley's personalization to create powerful response rates.

ICP precision dramatically affects results. Customers with well-defined, specific ICP criteria see 2x better performance than those with broad, generic targeting. Valley's scoring system works best when given clear qualification criteria. As one expert explained: "If your ICP definition isn't good, it will impact the quality of the scoring."

Campaign type selection matters for different industries. Some users report: "I get 60% of my meetings from InMails specifically," while others see better connection request performance. Running both in parallel maximizes coverage and allows Valley to optimize channel selection based on prospect characteristics.

Message approval method shows interesting trade-offs. Manual approval yields 1-2% higher response rates than autopilot, but requires 15-30 minutes daily. Most users find autopilot's slight performance decrease acceptable given the time savings, especially after the initial training period.

How Many Prospects Can Valley Contact Per Month?

Valley's outreach capacity is substantial while remaining within LinkedIn's safety limits. Per account, Valley can send approximately 600-700 connection requests monthly and 800 InMails to open profiles (plus your InMail credits for closed profiles). This totals roughly 1,500 prospects contacted monthly per account, with unlimited follow-ups to accepted connections.

The open profile identification is a game-changer. Valley identifies which prospects have open profiles (LinkedIn Premium members who don't require InMail credits), dramatically expanding reach. Users report: "People have gotten up to 800+ InMails in months in the past" without purchasing additional credits, just by targeting open profiles.

With multiple accounts, these numbers scale linearly. Three accounts (Valley Growth plan) can reach 4,500 prospects monthly. Ten accounts (Valley Scale) can contact 15,000 prospects monthly. This volume, combined with 9-11% response rates, generates substantial pipeline. The math is compelling: 1,500 contacts x 10% response rate = 150 responses monthly, with 25-33% being positive, qualified opportunities.

What ROI Timeline Can Companies Expect from Valley?

Valley delivers measurable ROI faster than traditional sales development approaches. Most customers see ROI positive within 60-90 days, with the investment paying for itself through booked meetings and pipeline generation. The timeline breaks down: Month 1 proves the concept with initial meetings, Month 2 scales successful approaches, and Month 3 achieves full productivity and positive ROI.

The economic comparison is compelling. Valley costs $395-995/month depending on seats, replacing SDR costs of $6,000-9,000/month per equivalent output. Even accounting for Sales Navigator costs and time investment, Valley delivers 10-20x ROI within the first quarter.

One agency reported: "We're looking at about 150K in pipeline in about four months" from a single user.

The compound effect accelerates ROI over time. As Valley learns your ideal messaging, refines its targeting, and builds a larger warm network, performance improves. Customers who've been using Valley for 6+ months report steadily increasing meeting rates and pipeline generation, with some achieving 30-50x ROI annually.

VALLEY MAGIC